If Southeast Asia has the lowest labor rates, why do they also have the best automation?

Compared to highly visible “mass” markets such as automotive electronics and smartphones, it’s easy to think of the market for industrial electronics as “niche.” However, in total, about 23% of PCBs produced worldwide are used in electronics equipment for manufacturing applications. If we include categories that are obviously non-consumer, such as telecom equipment, data-center computing, and solar/wind-power conversion, storage, and smart-grid control within our concept of industrial electronics, it’s clear this sector is extremely important to the world’s electronics producers.

As far as technology for manufacturing is concerned, we see organizations introducing digital transformation are profoundly changing the way they go about making, marketing, and supporting their products. Within this, smart manufacturing (aka Industry 4.0) leveraging cyber-physical systems, connected through the Industrial Internet of Things (IIoT), seamless linking of operational technology (OT) and IT infrastructures, intensive robotic process automation, and infusion of AI into edge devices and cloud services, is enabling companies to increase efficiency and agility, and improve standards of service delivery to customers.

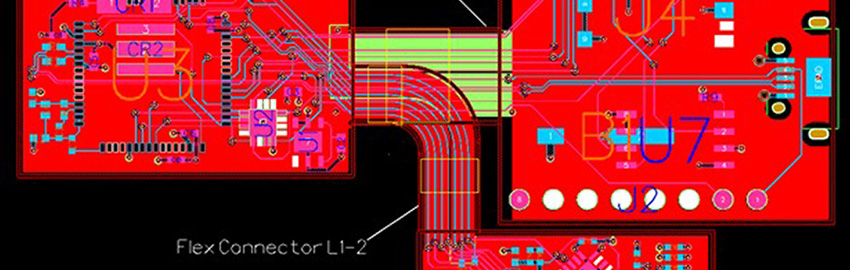

But moves toward pervasive automation are no longer purely about the drive to compete. For many years now we have accepted the view that Western high-tech manufacturers have driven high levels of automation to combat the labor-cost advantages enjoyed by offshore producers. It’s a notion that has become entrenched. In today’s world, however, the situation is rather different. Right now, the largest and most highly automated factories are found in China. It’s a simple fact automation is critical to be able to build advanced products meeting the expected levels of quality and reliability. End-user markets everywhere, from telecom and data centers to consumer smartphones, are expecting faster speeds, greater capacity, and more functionality. Automating key manufacturing processes – including the fabrication of advanced PCBs designed with progressively smaller and smaller feature sizes and hence finer and finer tolerances – is the only viable approach if manufacturers are to satisfy these demands.

The race is on globally. I recently visited some state-of-the-art PCB factories in Europe that are predominantly founded on automated processes fed by robotic handlers that are themselves supplied using automated guided vehicles (AGVs), and include fully automated 100% inline inspection and verification. Establishing and maintaining such fully automated factories is not cheap, but there is really no alternative. Automation cannot move forward without investment. Without automation, needed products cannot be built to the expected quality and reliability standards. And falling short on quality and reliability will lose the market.

This is understood everywhere: All manufacturers have the desire to compete and understand what it takes to do so. But it is clear the necessary capital structures are strongest and best adapted in Asia, where it is normal for organizations to work toward payback over, say, five, 10 or even 15 years. The financial structure to support heavy investment in advanced technologies is the one key ingredient I’ve heard Asian visitors in Europe remark is lacking in the West.

Perhaps this is why, despite the fact that major markets for high-tech products (all products, not only consumer electronics but also telecom infrastructure equipment, automotive electronics, and others) remain in the West, PCB production including production of advanced substrate materials and chemicals, as well as final board fabrication, is predominantly in Asia. And by some margin. Some 54% of today’s PCB fabrication takes place in China, with Taiwan and South Korea accounting for another 10% each. While production in Japan represents about 7% of the world’s output, that’s about the same as North America and Europe combined.

Things are different when it comes to final assembly of high-tech products. A significant proportion of surface-mount assembly of industrial electronics equipment destined for consumption in Europe now happens in countries on the edge of the Bloc. Former Eastern European countries such as Hungary, Poland, Romania, Slovakia, Czech Republic and others have become important electronics manufacturing destinations.

In addition to producing equipment for use in smart factories, manufacturers in these locations are supporting Europe’s strong presence in the renewable energy sector, including high-efficiency power filters, inverters, storage-battery systems, and grid-tie electronics.

This is heavily dependent on power electronics for conversion and control, maintaining acceptable power quality, as well as advanced smart grid equipment to manage feed-in and balance energy flows using techniques such as demand-side management.

From a supplier’s perspective, the globally dispersed nature of high-tech manufacturing and long-term economic shifts, as well as short-term effects such as political uncertainties, challenge us to get products in the right place at the right time and provide the support that customers need. At Ventec, for instance, although our major manufacturing centers are in Taiwan and Suzhou, close to where the majority of the world’s PCB manufacturing is focused, our distribution network is global and entirely self-owned, giving us control over quality of service delivery and the way we respond to changing situations.

In the longer term, although consumption in Asia is currently low compared to output destined for Western markets, the picture is likely to change due to rising domestic demand, as the growing Asian middle classes acquire more disposable income to spend. This will be manifested not only in increasing sales of high-end consumer products but also growing demand for high-performance telecom and data infrastructures and technology for smart transportation, smart energy and micro-generation, driving further large-scale shifting in global manufacturing capabilities.

Alun Morgan is technology ambassador at Ventec International Group (ventec-group.com); This email address is being protected from spambots. You need JavaScript enabled to view it..