EL SEGUNDO, CA – Already reeling from a major downturn in business conditions, DRAM suppliers now face another challenge: raising money for servicing debt and for funding capital spending, according to iSuppli Corp.

“Although the epicenter of the credit crisis is in the United States, banks from all over the world are being strained by the US housing market and by the destabilizing impact of bank failures in the nation,” said Nam Hyung Kim, director and chief analyst for iSuppli.

“Even with the expected intervention by the US government, this crisis means the cost of capital will rise because cash-strapped banks will be reluctant to take on big, risky ventures. This is a particular challenge for the capital-intensive DRAM manufacturing business. DRAM suppliers that already are facing cash issues soon may not be able to service debts that are coming due soon. Furthermore, DRAM suppliers may encounter problems in trying to finance their capital expenditures.”

Kim warned that some DRAM firms would face serious liquidity issues in the near future, based on the pace of their cash burn and the maturation of their short-term debt.

“Amid weak market conditions and the credit crunch, cash management has become the most critical issue facing DRAM suppliers,” Kim observed. “This will have the impact of reduced capital expenditures among DRAM suppliers in early 2009.”

While some observers have identified DRAM supplier Qimonda AG as being the company most at risk because of current conditions, iSuppli believes the German firm is on more solid ground than many of its competitors.

“Qimonda actually has a relatively good cash balance and a low debt ratio for potential leverage in the future compared to many other DRAM suppliers,” Kim observed.

The credit crisis comes on top of rapidly deteriorating conditions in the DRAM market, says the firm.

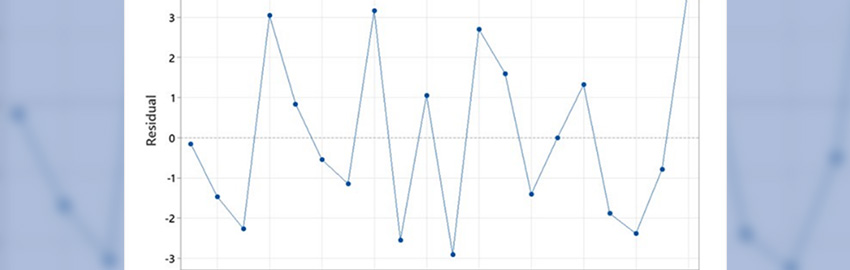

iSuppli on Sept. 22 cut its rating of near-term conditions for DRAM suppliers to negative, from neutral, as a result of severe oversupply, weak demand, unexpectedly sharp price declines and the approach of a seasonally slow period for the market.

DRAM demand had been strong until the second quarter. However, the situation changed starting late in the third quarter. Worrying signs for PC demand include a warning from Dell that sales growth would fall short of previous expectations in the third quarter. Furthermore, several retail outlets also reported disappointing sales forecasts for the third quarter, says iSuppli.

Beyond that, woes in the financial sector may impact DRAM sales. The financial area is one of the major corporate markets for PCs, and current challenges in this industry, including large-scale layoffs and delays in purchases because of the uncertain economic situation, represent a further downside for PC sales, according to the firm.

On the supply side, DRAM inventories have swelled far above nominal levels, not only among the memory suppliers themselves, but also for the channel and OEMs. Furthermore, DRAM suppliers have been aggressively releasing inventory to the spot market.

“The growing margin between spot and contract prices is a bearish sign for future DRAM pricing and demand,” Kim noted. “OEM contract prices for 2Gbyte PC DRAM modules will further decrease to the $20 to $25 level, down from the current $30 to $35 range, due to the flood of inventory. This level of pricing represents a ‘dead-zone’ for manufacturers, because it is less than the variable costs for the most DRAM suppliers.”

Some of the DRAM suppliers will stop shipping commodity DRAMs to reduce their cash burn early in the fourth quarter. However, this won’t be sustainable. As the end of 2008 approaches, suppliers will be under tremendous pressure to meet their annual budgets, which will worsen market conditions further in the future, says iSuppli.

“Perhaps the only good to come out of the economic downturn is that DRAM players will lack the cash to over-invest, thus curbing supply growth,” Kim said. “This will bring an end to the oversupply on the market, a situation that has been so disastrous for the industry in 2007 and 2008. The market eventually will turn around – although not for a few quarters at least. However, the timing of the DRAM recovery will hinge on the timing of the economic recovery, which no one can determine at this time.

“However, there is no good news in the DRAM industry right now,” Kim added. “The DRAM crisis is continuing along with the financial crisis. Until iSuppli sees meaningful production cuts from tier-one suppliers or near-term major consolidation, we will maintain our negative rating for near-term conditions for suppliers.”