SUNRISE, FL – Nano Dimension reported third quarter revenues of $438,000, down 80.5% year-over-year and up 52% sequentially. The decrease is attributed to continuing delays in identified transactions of DragonFly systems, which the company primarily attributes to the impact of Covid-19.

Net loss for the third quarter was $20.7 million, compared to $4.3 million in the same period last year and $8.3 million in the prior quarter. The increase is mainly attributed to share-based payment expenses of approximately $15.9 million that were recognized during the quarter.

The company ended the quarter with a cash and deposits balance of $45.7 million, while net loss was $20.7 million and negative adjusted EBITDA for the third quarter was $3.4 million.

“These are not disappointing results per se,” said CFO Yael Sandler. “As we have projected starting April 2020, the reduced revenues in 2020 as a result of the Covid-19 pandemic being prolonged and reemerging crises were in fact expected to be lower than we have achieved. Actually, in APAC, the revenues have seemed to already start a modest recovery in the fourth quarter of 2020. We believe the United States is still in a process of downswing of capital expenditures under the influence of the Covid-19 pandemic, and European prospective customers are sinking back toward a commercial standstill under the effects of its second wave. As the market stagnation is prolonged, understandably hesitant and/or careful customers tend to delay investments in breakthrough, new prototyping and fabrication technologies of unique Hi-PEDs (high-performance electronic devices). While the phenomena are clear and present, they are probably temporary.”

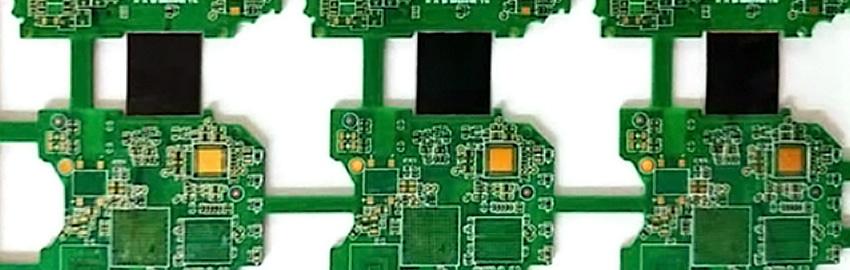

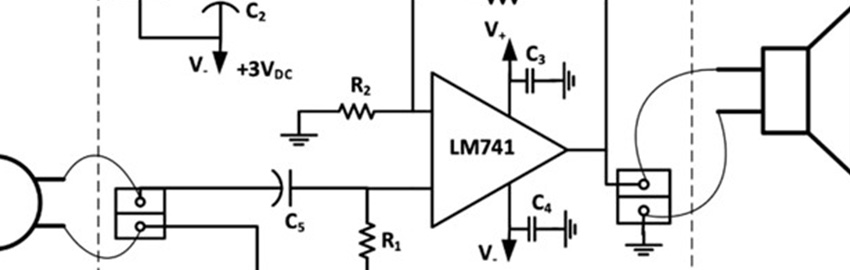

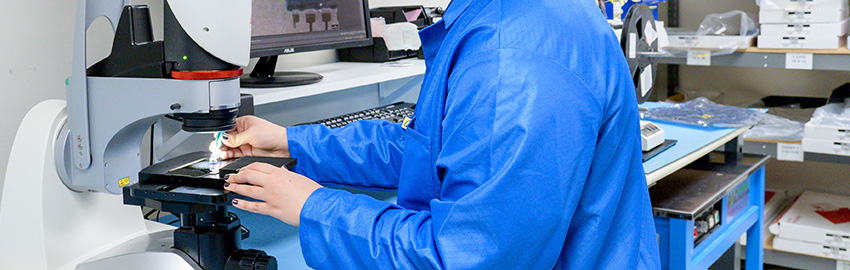

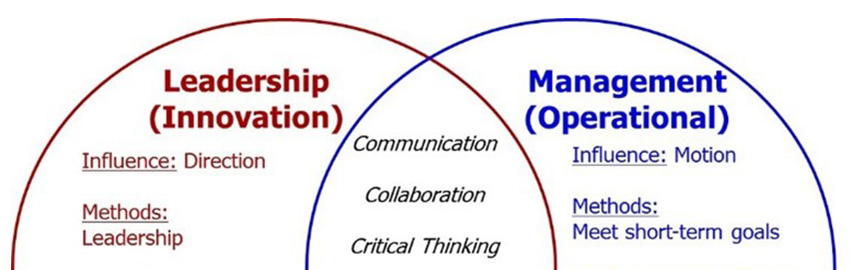

“The expectation of our market growth has not changed, and we believe this is an interim delay,” said CEO and president Yoav Stern. “We expect the midterm slowdown effect to act like a sling shot once Covid-19 starts to phase-out. The pressure of the trade struggles with the east is already creating an interest in reshoring electronic manufacturing. Nano Dimension technology is ideally positioned, as our 3-D printing machines for Hi-PEDs are an environmentally friendly non-polluting fabrication and overnight prototyping methodology, fitting for setting up fabrication facilities in-house on the western continents.

“As per above, we are not judging, at this point, our success by quarterly revenues. That will come later. Nano Dimension operates along an expected fail-safe investment model, where upside may resemble Biotech investments, but, contrary to those, downside in case of failure at any stage is somewhat hedged and hence protected. We have sold 60 machines already, mostly to leading blue chip defense, academic and commercial organizations worldwide. It is reasonable to assume in case a decision is made at the right time, a sale of our existing business at improving multiples, as per future stages, is a doable task. On the upside, an exponential growth post-Covid-19 may lead us to an unprecedented leadership role.”

R&D expenses for the third quarter were $2.6 million, compared to $2.1 million in the third quarter of 2019 and $1.9 million in the second quarter of 2020.

For the nine months ended Sept. 30, total revenues were $1.4 million, down 72% year-over-year.

Net loss was $31.1 million, compared to $7 million in the nine months ended Sept. 30, 2019.