One of the things I have learned over the past few months is that being the editor for a leading publication in the PCB design and fabrication space provides me with some unique opportunities to gather and disseminate information. With PCD&M's sister magazine, Circuits Assembly, UP Media Group is in a unique position because we cover the entire electronics industry supply chain. We often gather information from our readers through our own customized e-mail delivered "survey blasts." We really appreciate your participation in these impromptu industry issue surveys. You help us stay on top of the trends and let us know what you want to hear more about.

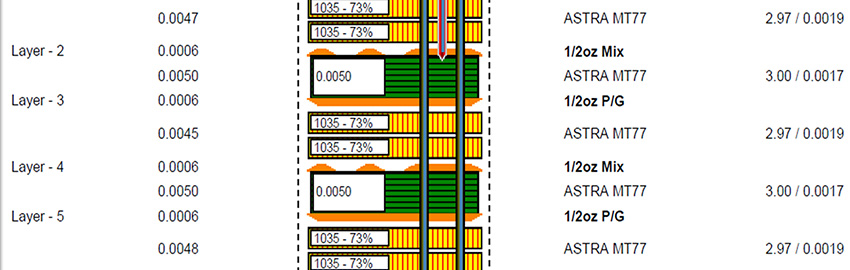

We recently completed a survey that focused on our industry OEMs. They hailed from segments that proportionally represented electronics manufacturing. In the area of enabling technology, respondents identified the following trends: Almost 50% indicated that their company's current products contained blind vias and 34% said they were below 5 mils in size. Only 11.1% indicated they used embedded passives. Looking forward we asked for their 12-18 month projections about the adaptation of these same leading-edge technology indicators. Fifty-six percent expect to be designing using blind vias and 52.5% said their vias will be under 5 mils. The statistic that blew me away was the change in anticipated implementation of embedded passives. The projections are that 24.6% of the PCBs, up 222% over current figures, will incorporate embedded components. Are we on the brink of widespread acceptance?

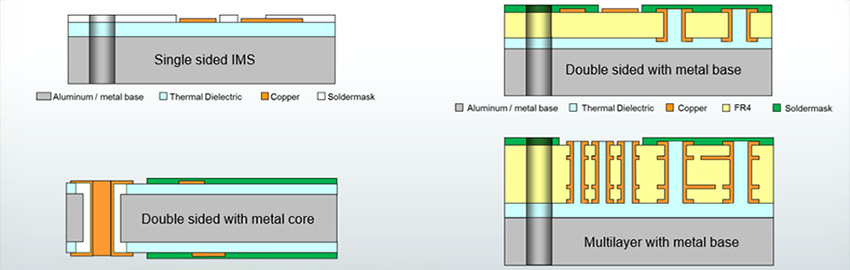

Like many novel and enabling technologies, embedded component technology has been around for a while. There is interest from the military, aerospace and high-end computing sectors where implementation of the technology not only reduces size and weight but can also dramatically improve performance. In general these lower volume, higher cost applications are less concerned with the cost side of the value proposition. They are more focused on what the technology can do and key in on the performance improvements gained for their specialized applications, an approach that isn't realistic for high-volume manufacturing. There, the prevailing, and often unanswered, question blocking new technology adoption is not what can it do? but rather how much will it cost? These cost considerations are mitigated only when it is impossible to meet the design objectives of advancing densities any other way.

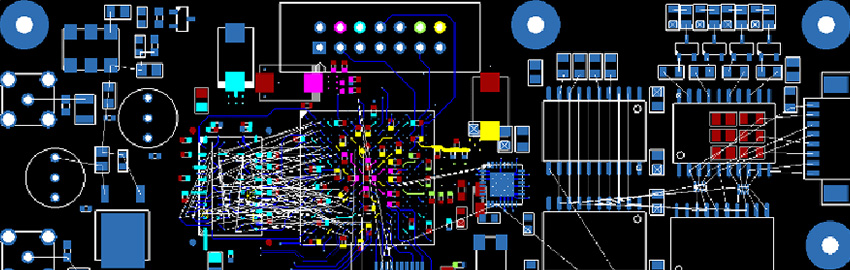

Getting to the value proposition for embeddeds is not an easy task. A number of scholarly approaches carefully list the specific areas that need to be compared. When I looked at one such list from a paper presented by the University of Maryland covering cost analysis, it became clear to me what the problem has been. The key elements needed to form the cost analysis included PCB fabrication, discrete component and assembly-related costs. The factors included specific items such as fabrication throughput and board yield that would relate to a specific fabrication location. Overall assembly yield, assembly cost and assembly-level rework are also factored in. And there are the individual discrete component costs that must be exact if the model is to be successful in delineating the total comparison.

Most of the time designers, who are the ones wrestling with these new technologies, don't readily have all the information needed to generate the value proposition. Embedded technology affects the entire supply chain, from design planning, through engineering and layout. It is often fabrication partner and material/process specific. It involves parts procurement because we need to calculate in the cost of the eliminated parts. And many of the cost benefits are not fully realized until the product reaches assembly and test. To generate the value proposition for embedded technology requires communication across the entire supply chain. Success in technology innovation that provides that needed competitive advantage can often be measured by how effective we are in communicating within our company and to our suppliers and subcontractors. If our survey is correct and the OEMs anticipate a twofold increase in their deployment of embedded components during the next 12-18 months, we will still need to diligently continue the dialog along the supply chain. Our industry's ability to do this may be one of the few positive things to come from grappling with RoHS. PCD&M