Key questions about true costs, reliability and enforcement remain unanswered as the July deadline approaches.

The RoHS Directive goes into effect in the EU next month, and the big question is, are we ready? Since January 2003, when the directive was passed, the industry has worked feverishly to prepare for its requirements, with a particular focus on the transition to lead-free processing. Industry is, for the most part, ready, but much work remains for the next few years to reduce the ongoing costs of maintaining RoHS compliance, address additional legislation and changing regulations around the world, and complete and optimize the conversion from eutectic solder.

Holly Evans, president of Strategic Counsel LLC, a consultant to electronics manufacturing companies on RoHS and WEEE environmental compliance issues, says that larger companies seem to be well-prepared to comply with RoHS but many small and mid-sized companies are lagging.

This viewpoint is borne out by recent research. A December 2005 survey1 of 162 OEMs and EMS providers found disparity in preparedness between large and small companies (Table 1 [PDF format]). The poll found that 80% of responding companies with sales exceeding $1 billion expect to comply with RoHS by July 1. However, only 47% of companies with sales under $100 million expect to comply. Among mid-tier companies (sales between $100 million and $1 billion), 55% said they expect to be in compliance by the deadline.

A benchmarking study by Technology Forecasters Inc.'s TFI Environment on behalf of one of its members provides more in-depth discussion of RoHS compliance issues. This study included interviews with 11 telecommunications OEMs and five of their suppliers (EMS providers, component suppliers and solutions vendors). All but two of the OEMs interviewed plan to take the lead-free exemptions for networking/telecommunications products and four plan to take the spare parts exemption.

The decision to take the permitted lead exemption - by the companies surveyed and others that manufacture high-reliability products - is leading to a dual technology and supply chain structure, which poses additional challenges. The U.S. military has recently recognized that, in spite of being exempt from RoHS, it is impacted because of the difficulty in purchasing lead-bearing components.

Reducing costs of RoHS compliance. The TFI study showed that nearly all companies surveyed plan to perform due diligence in declaring their products compliant and intend to take the same compliance approach for China RoHS. Most of the OEMs surveyed are using third-party software to track and report materials contents, while a few have developed and implemented proprietary tools. The recently released IPC-1752, Materials Declaration Management, establishes uniform electronic data formats and standardized forms to simplify collection, tracking and disclosure of material content information.

"The entire electronics supply chain is concerned about being able to establish the information necessary to demonstrate compliance," says Richard Kubin, vice president of E2open Inc., and chair of the IPC and iNEMI committees that developed the standard. "IPC-1752 allows companies to utilize a consistent format both for collection of data as well as its distribution. The associated XML schema and standard forms allow for the automation and direct integration of this information into key internal systems, greatly reducing the manual effort required in managing compliance."

This initial standard is but the first step in working to reduce the financial impact of RoHS on the industry.

Addressing regulations and legislation. The past 18 months were extremely active from a legislative viewpoint in the EU. All 25 member states have now implemented RoHS through national legislation, and several member states have detailed regulations and guidance in place.

Maximum concentration values for the substances controlled by RoHS were established in August 2005 (up to 0.1% by weight in homogeneous materials for lead, mercury, hexavalent chromium, PBB and PBDE and up to 0.01% by weight in homogenous materials for cadmium). In May 2005, the European Commission (EC) issued additional guidance in the form of a "frequently asked questions" document intended to help member states interpret the directives, and to serve as a reference for companies that will have to comply with the national laws transposing the directives.2 Despite this flurry of activity, many key legal issues are yet to be resolved.

"There are still many proposed exemptions being considered by the EC," says Jean-Philippe Brisson, an associate with the NY law firm of Allen & Overy. "We are seeing diverging interpretations of the phrase 'put on the market,' which must be resolved, along with the larger issue of how to provide a common enforcement approach across the EU. There is also discussion about bringing medical devices and monitoring and control equipment - products currently not covered by RoHS - into the scope of the RoHS Directive."

Exemptions. The RoHS Directive lists several product and application exemptions, and several more are under review. The EC issued decisions regarding additional exemptions in October 2005 and on Feb. 26, 2006. Sixty additional exemptions have been proposed through "stakeholder consultations," and the majority of these are still under consideration. Independent consultants reviewing proposed exemptions will be reporting monthly, with a final report scheduled for July. Among the exemptions being considered are: 1) the use of lead in tin-whisker resistant coating for fine-pitch applications; 2) lead in connectors, flexible printed circuits and flexible flat cables; and 3) use of the six restricted substances in electrical and electronic equipment (EEE) used in the aeronautics and aerospace sectors that require high safety standards.

Consistent enforcement. A challenge for companies selling EEE products in the EU is knowing how RoHS will be enforced from state to state. Each member state has implemented the directive through national legislation, and there are differences between their laws.

In January, the U.K. hosted a meeting to discuss development of a guidance document for enforcement bodies. This document, which would be purely advisory rather than legally binding, would outline the principles to support RoHS enforcement, such as the documentation that "producers" should keep, how enforcement bodies might use such documentation to check for RoHS compliance, and how and when sample preparation and analytical testing might be employed. The EC and member states at the meeting expressed support for such a document, with the objective of establishing a common enforcement approach across the EU. The proposed approach is one of risk-based market surveillance and seeking documentation before proceeding to testing if necessary. Once the document is agreed to by the member states, it will be published and made available to all stakeholders.

From Dual Technology to Lead-Free

While industry appears to be ready for the RoHS compliance deadline, the transition to lead-free manufacturing is really just beginning. The industry has nearly 50 years of experience with SnPb eutectic electronics manufacturing and, even with an accelerated learning curve, manufacturers will be coming up the lead-free learning curve for another decade to reach the level of knowledge of SnPb processes.

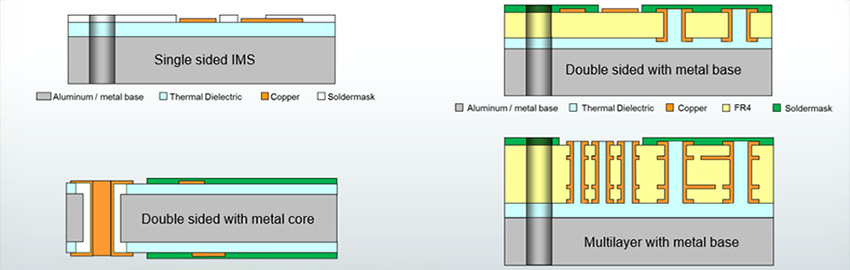

Matters are complicated further by the lead exemptions permitted to the RoHS deadline for certain high-reliability products (military applications, control circuits, servers and telecommunications, to name a few). As a result, some SnPb eutectic manufacturing will coexist with lead-free manufacturing for the near future. This duality increases costs and complexity throughout the supply chain, requiring companies to create and maintain duplicate component part line items, manufacturing processes, suppliers, etc. This duality also increases the risk of noncompliance due to the potential of mixing, and it complicates industry's ability to meet quality and reliability requirements.

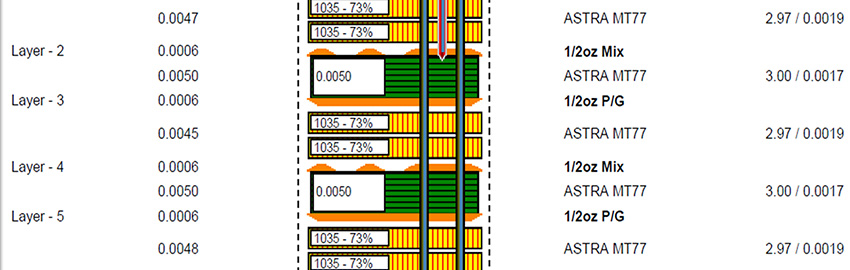

From an electronics manufacturing perspective, the industry has generally converged on a few key parameters to comply with the July 1 deadline:

1. Solder alloy is typically SnAgCu, in varying compositions, such as SAC305 or SAC405.

2. Surface finishes are typically organic solderability preservative (OSP), immersion silver (ImAg) or electroless nickel immersion gold (ENIG).

3. Solder reflow temperatures range from 230° to 250°C.

Industry is still working to solve a number of issues related to conversion. iNEMI, for example, has eight ongoing projects to investigate issues related to lead-free processes, but they will not be completed by July 1:

- Lead-free BGAs in SnPb assemblies.

- Lead-free defects per million opportunities.

- Lead-free nano-solder.

- Lead-free rework optimization.

- Lead-free wave soldering.

- Substrate surface finishes for lead-free assembly.

- Tin whisker accelerated test.

- Tin whisker modeling.

Intel Corp. recently held a lead-free symposium, sponsored by IPC. Based on their early implementation of RoHS-compliant components, modules and circuit boards, Intel found that the electronics industry has not yet optimized lead-free manufacturing parameters to meet the best cost, quality/reliability and delivery requirements for the entire spectrum of electronics products. Intel shared the experiences, knowledge and lessons learned during their conversion to lead-free manufacturing, and encouraged other manufacturers to do the same.

Attendees representing 76 different companies across the entire supply chain openly exchanged technical information and concerns about the challenges of lead-free manufacturing. Breakout sessions provided discussions in six key areas:

1. Ball grid array solder alloy optimization for drop shock performance.

2. Solder flux optimization for ball grid arrays.

3. OSP metrologies and standards.

4. Laminate crack/pad crater metrologies and standards.

5. Planar micro-voids root cause, metrologies and standards.

6. Common reliability/shock test methods and metrology specification for mechanical performance assessment.

Each session closed with a call-to-action to the electronics manufacturing industry to work together on solutions by engaging in or forming new working groups within industry bodies such as IPC, iNEMI, Jedec, etc.

For the past decade industry has been working to develop alternatives to SnPb eutectic solder in anticipation of legislation. But additional work will be necessary, as currently exempted segments of the industry are required to comply. Industry needs to work together to close the gaps as identified here and, in the future must become proactive in identifying and resolving potential areas of environmental risk. PCD&M

Bob Pfahl is vice president of operations for the International Electronics Manufacturing Initiative (www.inemi.org); This email address is being protected from spambots. You need JavaScript enabled to view it.. Kurt Goldsmith is general manager, systems manufacturing technology development, for Intel Corp. (www.intel.com); This email address is being protected from spambots. You need JavaScript enabled to view it..

References

1. Poll conducted by Electronics Supply & Manufacturing and Design Chain Associates, December 2005.

2. European Commission,

http://europa.eu.int/comm/environment/waste/pdf/faq_weee.pdf, May 2005.