How many greenfield fabrication plants do you think have been built in the US in the past 10 years?

I can think of three, and two of them were designed and built by the same person and corporate parent. There’s Whelen Engineering, the OEM that opened a captive shop in 2015. The brains behind that, Alex Stępiński, then designed and built GreenSource Fabrication, which launched in 2018. And perhaps we can count TTM’s new plant in Chippewa Falls, built in a converted 20-year-old, 40,000-sq. ft. warehouse and officially opened last winter.

Now we can add one more to the list. More surprising, an EMS company built it.

Last month Benchmark Electronics opened the doors to its 122,000 sq. ft. state-of-the-art factory in Phoenix. The company, the fifth largest EMS in the US and 18th in the world according to the CIRCUITS ASSEMBLY Top 50, is known for putting components on boards, not making the substrates themselves. The new venture is a leap of faith, buoyed by the desire to control the product development from end to end.

To continue reading, please log in or register using the link in the upper right corner of the page.

{!guest}

“One of the elements that we recognize (customers) want to control is the ability to design, develop and locally fabricate high-performance circuits and interconnects here in the US,” said Daniel Everitt, vice president, Benchmark Lark Technology, the company’s RF and high-speed electronics unit.

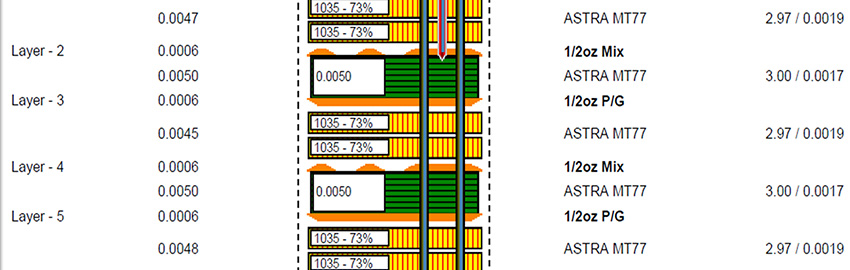

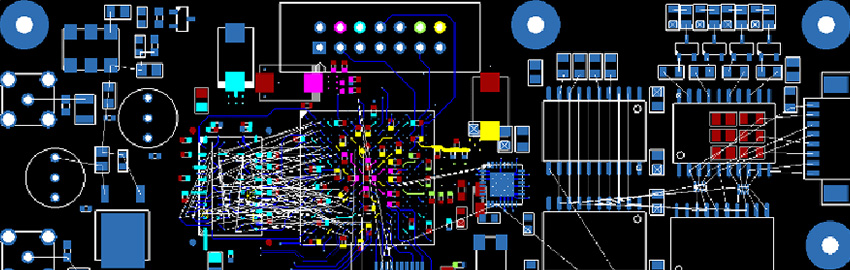

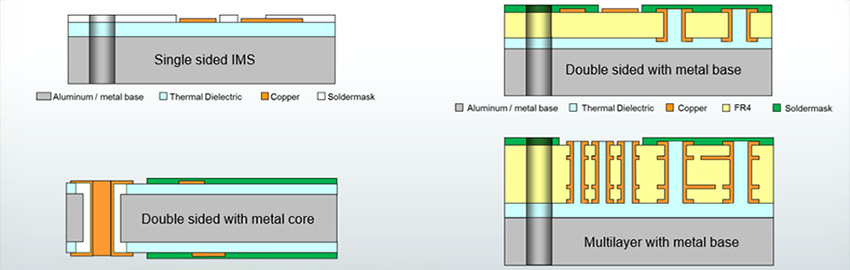

Benchmark Lark appears loosely modeled after Jabil’s successful Blue Sky centers, a foray merging advanced materials and assembly technology into a collaborative unit capable of highly integrated design through end-product development. What Jabil lacks, however, is internal fabrication capability. There, Benchmark has reimagined the vertically integrated manufacturer. Benchmark Lark’s high-end target is RF systems that perform up to 110GHz and 3-D heterogeneous integrated (3DHI) circuit boards, all designed, built and tested under one roof. Benchmark Lark put in an MSAP line and can build 1 mil (25µm) lines and spaces with its laser-direct imager (LDI). The technology investment is there.

Everitt says the fab shop gives Benchmark “the opportunity to eliminate superfluous packaging, achieve high-reliability designs and performance for our customers, as well as mixed technologies where we mix an SMT and microelectronics assembly to create a hybrid module, which is commonly used in space, military and defense applications for the most highly demanding scenarios, as well as the highest reliability scenarios.”

He adds that the fully vertically integrated design center, which extends from concept to prototype product development to volume production, features a custom-built state-of-the-art factory 4.0 lights-out SMT line.

I have several questions I was unable to get answered prior to the deadline for this month’s issue: When was the decision made to add a fab line? How does the plant manage the water requirements and environmental regulations? Is it closed-loop? What drove the decision to implement MSAP vs. other plating processes? Will the bare boards be sold to other EMS or strictly as part of a “package” that includes EMS and other services (design, box build, etc.)? Will Benchmark fab boards it did not design? And that’s just the start. Readers should check back to our website for the follow-up.

For many, the driving factor to onshore product is lead time and protection of intellectual property. Yet, while the US may want to reshore, what is left to bring back? Domestic companies no longer have large offshore holdings. MFlex is in Chinese hands. So is Multek. TTM’s Mobility unit has been sold. Sanmina has plants in Wuxi and Singapore. TTM still has some six Chinese fab operations, and Amphenol has smaller plants in China and the UK. Several smaller companies have sister plants in India, but the cumulative value of those “imports” is perhaps $400 million. Measured against the worldwide figure of roughly $70 billion, that’s a rounding error.

I am not suggesting a mass move to vertical integration is imminent. In fact, I see more movement the other direction. Foxconn spun out its fabrication operations. Flex shed its rigid board unit. Sanmina’s bare board sales drop almost every year. Benchmark is going firmly against the grain.

It’s audacious. But I like it.

P.S. Thanks to Rick Hartley for his two-hour webinar on IoT PCB Design and Layout. As Rick notes, the market is set to explode with billions of devices. You can still view it on-demand at zoom.us/webinar/register/5315907776290/WN_bFuW1oUJQbyZVdLB7_GBjQ, or catch Rick’s full-length version at PCB West in September.

Register now for PCB West, the leading conference and exhibition for the printed circuit board industry! Coming this September to the Santa Clara Convention Center. pcbwest.com