SINGAPORE – Global PC and tablet shipments will fall 7% year-over-year to 367.8 million units in 2020, according to Canalys. The firm expects the global PC market to stay flat in 2021 and return to growth of 2% in 2022.

Though the PC market has been rattled by the impact of Covid-19, the worst is behind us, the company says, as the second, third and fourth quarters are expected to post smaller year-over-year shipment declines than the first quarter. This is mainly due to a return to a healthy supply chain and manufacturing base in China, which will serve pent-up demand in segments such as remote working and education. Nevertheless, the recessionary impact of the coronavirus on global economies will not be minor, and consumers, businesses and governments will prioritize vital spending ahead of PC refresh.

“From a category perspective, notebooks have been at the center of a demand surge that has left vendors and channel partners scrambling,” said Ishan Dutt, analyst at Canalys. “We expect this demand to persist as many businesses that have been forced into home working and found it successful are now choosing to implement it on a larger scale. The same holds true for education, where schools have made investments in digital curricula and are implementing only partial returns to on-premises learning. Desktop refresh will suffer to a greater degree as businesses face prolonged uncertainty about the scope of their operations and dedicated office space needs. Tablets, which have the greatest reliance on consumer spending, will face a slump as holiday season demand in the fourth quarter is expected to take a hit this year.”

“Covid-19 has given the PC industry a boost,” said Rushabh Doshi, Canalys research director. “Despite the progress that smartphones and tablets have made in recent years, the need for a high-performance mobile computing device has never been more pronounced. As countries emerge from this crisis and the ensuing economic slump, spending on technology solutions will be a key recovery driver. Canalys expects the global PC market to return to growth of 2% in 2022, with desktop and notebook shipments overcoming prolonged weakness in the tablet space. But it is important to keep things in perspective: A modest recovery from a weak 2020 will not see the PC market return to the highs of 2019 for some years to come.”

Canalys forecasts PC and tablet shipments will fall 3% in 2020 and will post growth of 4% in 2021. While China was the worst hit economy due to the pandemic in the first quarter, it is one of the best placed in the second quarter and beyond. It has already borne the brunt of the pandemic, and, barring an unlikely second wave in the second half of 2020, the company expects demand in China to be robust for the rest of the year. In particular, Canalys expects the pent-up demand from the first quarter will lead to a big boost in sales in the second quarter. While local demand may hold strong, China’s economy remains reliant on exports to countries that could face deeper recessions. This would have an especially strong secondary effect on its large base of export-focused SMBs. In the long-term, the government’s plan to invest around US$1.4 trillion over six years in the technology sector will provide ample opportunities for the PC ecosystem.

Canalys forecasts the PC market in Asia Pacific will fall 1% year-over-year in 2020, and market recovery will start in 2021. Asia Pacific is a region that was hit hard by the Covid-19 pandemic, starting late in the first quarter. While countries such as South Korea are already well on their way to recovery, the majority of South Asian and Southeast Asian countries are only now experiencing an easing of lockdowns. In these markets, while commercial demand is expected to be strong for the rest of 2020, consumer demand will not keep up. As PCs are not essential goods for most consumers, ongoing and upcoming recessions in these countries will adversely affect demand. Consumers will choose to delay and minimize spending on nonessential goods as far as possible, so we may see a lengthening of refresh rates, says Canalys.

Total PC and tablet shipments in North America will drop 6% year-over-year in 2020. The US, as the world’s largest PC market, was affected by supply shortages in the first quarter, but Canalys expects a strong surge in demand in the second quarter, driven by large enterprises looking to enable their employees to work from home, as well as a demand boost for Chromebooks from the education sector.

But, with the economy in disarray and unemployment rising above the 20% mark, consumer demand is likely to wane toward the end of 2020. The fourth quarter might not enjoy its usual boost. If the economy doesn’t show major signs of recovery by then, Canalys expects consumers will move away from discretionary spending on nonessential devices, such as Apple tablets, at the end of the year. The firm expects the recovery in the US to be delayed until 2022, when the market will grow 4% year-over-year.

As most major markets in Europe are starting to relax lockdown measures, Canalys expects a short-term demand bump that will soften the shipment decline in the second quarter to 1%. But with the bulk of commercial refresh having occurred last year, and businesses and consumers being forced to tighten their purse strings, the second half of 2020 will see sharp declines on the equivalent period in 2019. Countries in Africa and the Middle East, which have suffered from low prioritization due to limited supply by vendors and the channel so far this year, will see some demand start to be fulfilled from the third quarter onward. Overall, PC and tablet shipments to EMEA are set to fall 10% in 2020 before posting growth of 1% in 2021.

Many countries in Latin America, including large markets such as Brazil and Mexico, are behind the curve on Covid-19, and are still reporting significant instances of infection and death. This, in addition to uncertainty about the scope of lockdowns and the likelihood of when they will be eased, means recovery of PC shipments is likely to take longer. On the supply side, local manufacturing in Latin America has also been disrupted by the pandemic. Canalys expects shipments to fall 16% year-over-year in the second quarter, with further declines of 6% and 9% in the third and fourth quarters, respectively. Latin America is expected to return to growth in the second quarter of 2021.

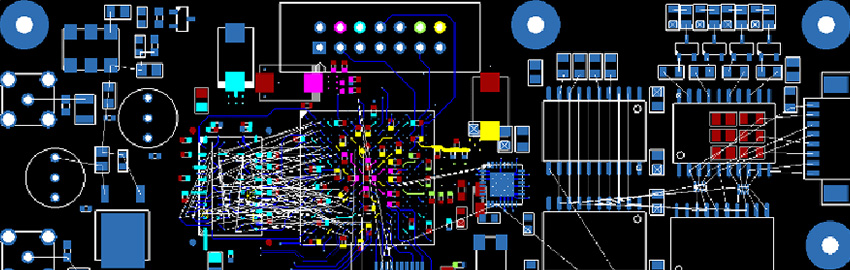

Register now for PCB West, the leading conference and exhibition for the printed circuit board industry! Coming this September to the Santa Clara Convention Center. pcbwest.com