FRAMINGHAM, MA – The overall tablet market for Western Europe declined 10.1% year-over-year, shipping 6.3 million units in the second quarter, according to the International Data Corp.

Slates exhibited a degree of resilience in the commercial space, following strength in certain niche use-case deployments, the firm says. However, market saturation, lengthening lifecycles and a lack of innovation resulted in the ongoing sluggish demand on the consumer side, leading to an overall decline of 6.1% compared to the second quarter of last year.

In terms of volume, detachables declined 23.3% year-over-year. As the market has become increasingly dominated by Apple and Microsoft, and consequently more premium-focused, the range of options available to more price-constrained customers has diminished, leading them to consider cheaper alternatives such as lower-end convertibles or even traditional PCs, says IDC.

Furthermore, the announcement of upcoming product releases from the main players likely acted as an inhibiting factor on overall demand this quarter, as customers postponed their purchases in anticipation of these newer devices.

"Apple repeated last year's successful strategy of positioning the iPad at a more attractive price point to address the erosion of consumer demand for tablets," said Daniel Goncalves, senior research analyst, IDC Western European Personal Computing Devices. "This triggered a wave of renewals of old iPads and some Android tablets, which helped Apple perform above the market average and regain the leading position in Western Europe.

"Huawei, the other winner in the Western European tablet market, continues to pursue its strategy of increasing its penetration in the region. In tablets, particularly, the company found its sweet spot in the lower midrange price bands and has been gaining market from other Android-based device manufacturers. Most of these companies are increasingly concerned about profitability and therefore reducing their presence in lower tier segments."

Apple ranked first with 30.7% market share, increasing 2% compared to the second quarter of 2017. This quarter's strength was largely driven by its slates, as the launch of the latest iPad led to strong performance in the consumer space.

Samsung ranked second, recording a market share of 22.3%, but decreasing by 14.2% year-over-year. This decline can be attributed to the sluggish performance of premium Android devices and a degree of inventory management in preparation for the launch of the Galaxy Tab S4, says IDC.

Huawei ranked third with market share of 9.1%, increasing 110.3%. Its penetration strategy within Western Europe has proven to be successful, as a solid growth of market share was achieved in the low-midrange space.

Lenovo ranked fourth with 7.6% market share, but with a decline of 23.4%. As it is primarily focused on consumer and lower-priced models, Lenovo was particularly susceptible to competition from Huawei and Apple's cheaper iPad.

Amazon ranked fifth with 4.4% market share, but declined by 8.6%. Consumers are postponing purchases until early July in anticipation of Prime Day.

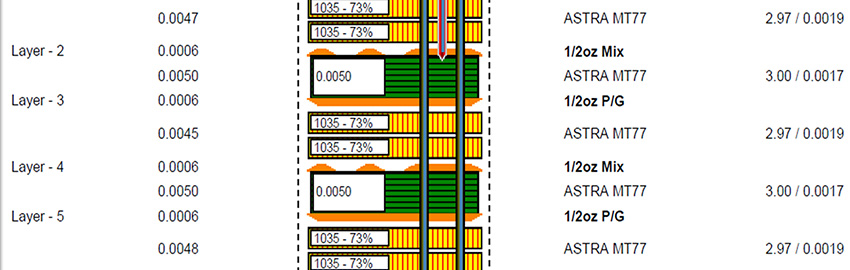

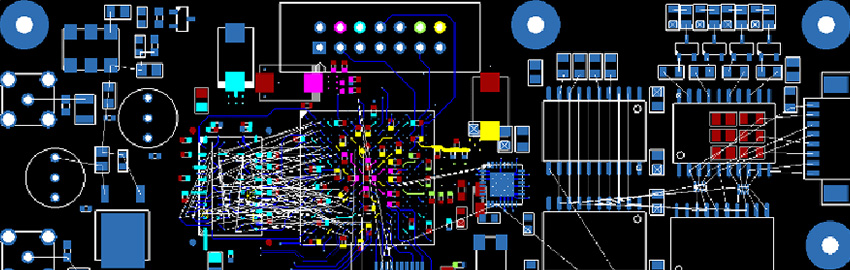

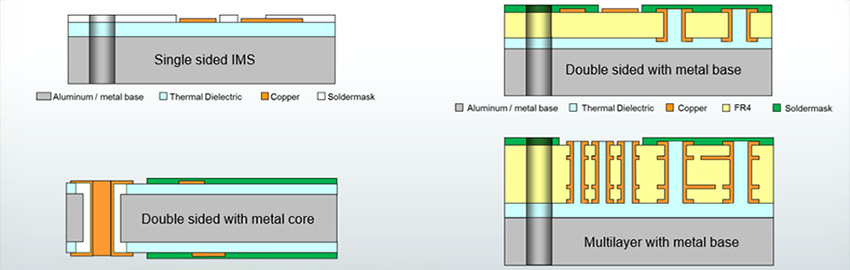

Register now for PCB WEST, the leading trade show for the printed circuit design and electronics manufacturing industry! Coming Sept. 11-13 to the Santa Clara Convention Center.