-

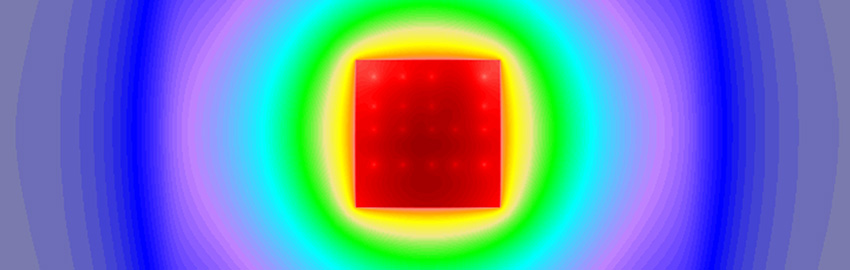

How the PCB Stackup Helps Control EMI

Power and signal placed on outer layers minimize radiated emissions.

READ MORE... -

Century Circuits

Which PCB technologies are best suited to survive 100 years?

READ MORE... -

Learning from the Past

What history can tell us about our position in high-tech.

READ MORE... -

Thermal Vias are Ineffective. Here’s Why.

Adding thermal vias can take up valuable board space with little benefit.

READ MORE... -

Connecting the Industry, from Boards to Assemblies

HDP is embarking on new rounds of evaluations of laminates and lead-free solders.

READ MORE...

Homepage Slideshow

How the PCB Stackup Helps Control EMI

Power and signal placed on outer layers minimize radiated emissions.

Century Circuits

Which PCB technologies are best suited to survive 100 years?

https://pcdandf.com/pcdesign/index.php/current-issue/241-designer-s-notebook/18061-century-circuits

Learning from the Past

What history can tell us about our position in high-tech.

https://pcdandf.com/pcdesign/index.php/current-issue/262-material-gains/18062-learning-from-the-past

Thermal Vias are Ineffective. Here’s Why.

Adding thermal vias can take up valuable board space with little benefit.

Connecting the Industry, from Boards to Assemblies

HDP is embarking on new rounds of evaluations of laminates and lead-free solders.