And will capital equipment makers stay put, relocate or – shudder! – exit the business?

In many ways, the past three years have seemed very much like a dream, with life shifting from normal to masked panic and social distancing, to light at the end of the tunnel, to where we mostly appear to be now: back to normal! But while most faces are uncovered, businesses have taken down Plexiglas separating cashier from customer, and retail floors have only a few faded "stand here" decals visible on the floors, not all is truly back to normal.

Geopolitical strains have developed in Asia and an unprovoked war is taking place in Europe. Both series of events – combined with the pandemic – put unprecedented strains on a global supply chain that for decades relied upon political stability and free access to countries around the globe. While the pandemic focused most of us on the here and now, it also caused companies – and countries – to pivot on where and how they source product.

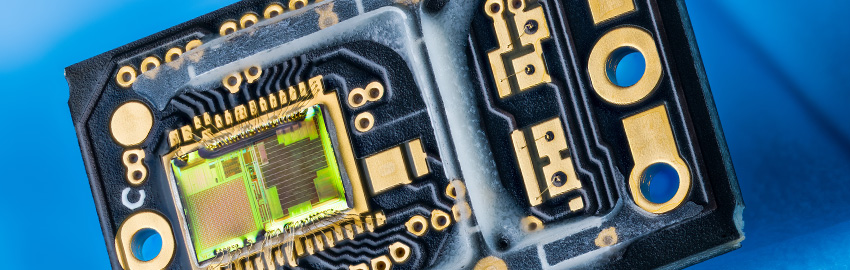

For North America, the lack of certain technologies, many central to our industry's ability to produce technology-rich products, became glaringly obvious and made many in industry and government even more concerned. That concern led directly to the CHIPS Act, which in time will certainly help alleviate some supply-chain issues in North America, although it is not a short-term panacea. For the rest of the world, however, strains will persist and possibly get far worse.

When a company establishes a global supply base or decides to open a facility in a different part of the world, it must make decisions such as where to invest and build new factories or R&D centers. These decisions are typically made with a long-term perspective, as once a beachhead is established, additional investments in facilities and staffing are far more cost-effective. This is especially true when companies decide to establish facilities in a new country. Besides the typical growth pains of teaching new workers a company's technology and way of doing business, adapting to a new culture and language(s) complicates the initiative and can impact short-term profitability as company and employees come up to speed.

When events, be they geopolitical or natural disasters or emergencies, make it necessary for companies to pivot relatively quickly, the risk grows exponentially. Moving a base of manufacturing across town is daunting enough. Moving countries can make any other relocations look like a cake walk. Transitioning from an existing successful facility to a new and unknown environment because of events outside your scope of control is rarely the recipe for success.

And yet today, many companies are looking at the global political landscape and considering whether to pivot to another country because of the inherent risk of remaining in place or as a hedge if risk escalates. While the analysis of making substantial investments in new locations is taking place, capacity expansion in the existing location is most likely on hold, as is replacement of capacity as equipment comes to the end of its useful life.

Over the past couple years many aspects of the global supply chain have eased, from a little to significantly. With all the geopolitical uncertainty in the world, however, it may be impossible to return to the resilient, inventory-rich supply chain we enjoyed – and relied upon – pre-pandemic.

For those in electronics, and our industry in particular, the ability to maintain adequate inventories of raw materials from laminate to components is key to success. Possibly even more critical – although not often discussed – is where the capital equipment needed for production will be manufactured. Will OEMs producing the machinery most used in our industry – but only by our industry, which generally means relatively low annual unit sales – have the wherewithal to move their manufacturing if necessary, or will they instead pivot what they make to higher volume, more lucrative markets? And what about other specialty suppliers? Even with a strained supply chain showing demand, is the cost of moving a facility going to be worth it?

It took decades to develop and refine the global supply chain we have come to rely on. Over a few years the supply chain has become strained, and the availability of product is more bumpy road than seamless flow. While much of life appears back to pre-pandemic normal, our industry will feel the strained supply chain for some time. Steady nerves and stout hearts are needed as companies navigate their way through what could be the beginning of a new supply paradigm – or a lengthy problematic period before the existing global supply chain settles back to normal.

Peter Bigelow is president FTG Circuits Haverhill; (imipcb.com); This email address is being protected from spambots. You need JavaScript enabled to view it.. His column appears monthly.