And how its misuse eradicates valuable business opportunities.

The unit price worksheet, or UPW, provides most EMS sales programs a platform for a precise quote in accordance with corporate cost guidelines. The presentation of the “official quotation” typically includes the UPW, which is labeled “Official Quotation,” a BoM list with a breakdown of component pricing, and a general review of terms and conditions. Use of UPWs as the official quote document has become standard practice for many EMS companies. The evolution of the EMS market has turned this once internal and confidential worksheet into a widely used standard issue. Through varied economic down periods, EMS companies have been groomed to eliminate poor business decisions by positioning finance departments to take close control of the quotation process. Today we see CFOs taking a strong role in the business development process. As a result, the UPW is a tool designed for the purpose of ensuring quotes abide by pricing guidelines set by finance departments. In parallel with this dynamic, OEMs have cemented the requirement for “open book” quotations to examine the quote makeup and its cost parameters. Thus, the unit price serves two functions in its application:

- For the EMS: Derivation of the unit prices.

- For the customer: Documenting the cost variables for the purpose of open book customer inspection.

For many EMS companies, the UPW serves as the instrument for price derivation. Although the UPW is useful in structure and provides ease in calculation, the document creates a major absence of relevant business considerations, as the EMS is assessing quotes and determining the value of the potential customer. The downside of the UPW is excused either by oversight of the EMS or choice to process RFQs through a straightforward and relatively automated process.

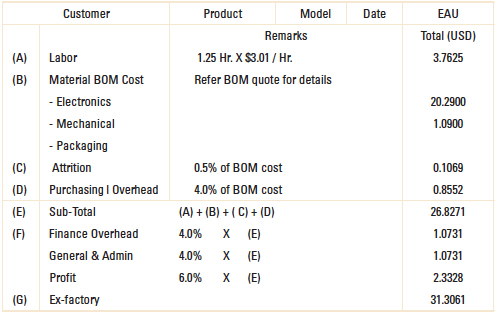

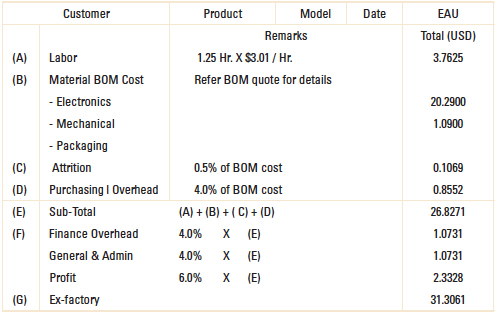

A typical UPW is modeled to provide quantifiable calculations to develop a unit price based on the factory’s internal cost structure and the cost of materials. Typically, the UPW is tweaked on occasion by corporate cost analysts to include updated costs for variables such as labor, management services, overhead and desired profit margins.

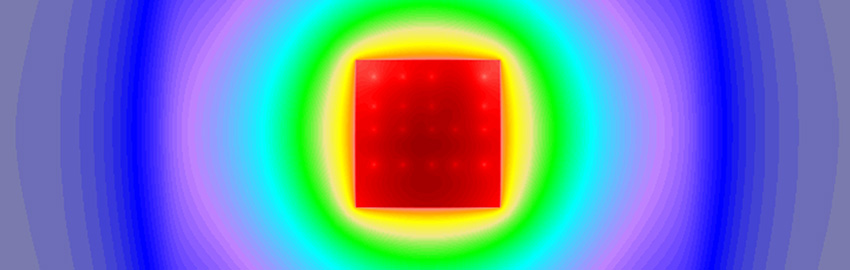

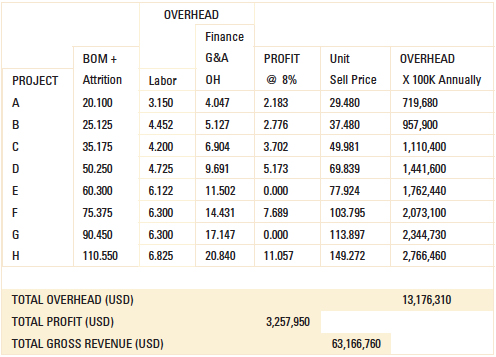

A typical UPW can be modeled as in Figure 1. This UPW is sometimes delivered “live” to customers. That is, it is contained in an active spreadsheet that can be updated based on changing parameter costs. With the worksheet modeled by CFO guidance, many EMS companies use the UPW as the so-called Holy Grail to calculate not only the selling price but a full breakdown of all of the overheads, manufacturing costs, management burdens and profit contribution. Using the UPW as the corporate price derivation gives the quotation process a degree of scientific validity, as well as a quick-turn result.

Figure 1. Unit Price Worksheet Official Quotation Form

The automated plug-in process of developing a quotation will bring about consequences. In both my own practice, as well as instances I have viewed, there have been numerous occurrences when the UPW caused a loss of business that was valuable, or even vital, to the EMS. By holding the UPW as the sole pricing gauge, the impact of surrounding business factors went unaddressed. As a result, business opportunities were mishandled and the true value of a potential customer was never weighed.

Undervalued Projects

In most EMS operations, the overall cost of operation remains fixed over an extended time period, as factories tend to operate with little or no retracting/expansion of overhead. Labor as well as management headcounts remain the same with utilities and facilities upkeep fixed. That is, regardless of moderate variations of production rates, the labor force does not vary; the facility overhead is fixed, and management and administration costs are the same. With this understood, the UPW will stymie any objective forward thinking that may be applied to justify the value of new business potentials. Using the UPW as the Holy Grail will eliminate the evaluation process of assessing the value of a potential customer. Instead, the value of the customer is measured by one significant line item: the profit line. This scenario yields poor readings on determining the value of a new business opportunity as it applies to the proposed EMS factory.

The UPW misses two key factors when assessing the value of a potential project: EMS overhead absorption and EMS marketing strategy.

EMS overhead absorption. With the understanding that operational costs are generally fixed, a decision to accept a program into the factory can be made if it may not equate to bottom line profits, yet it will serve to absorb overhead. Such a critical study and its necessary decision tree is lost if the UPW is revered as the Holy Grail. We see EMS sales programs spewing quotes and its field salesmen running the quotes up the flagpole without any such scrutiny of a decision tree.

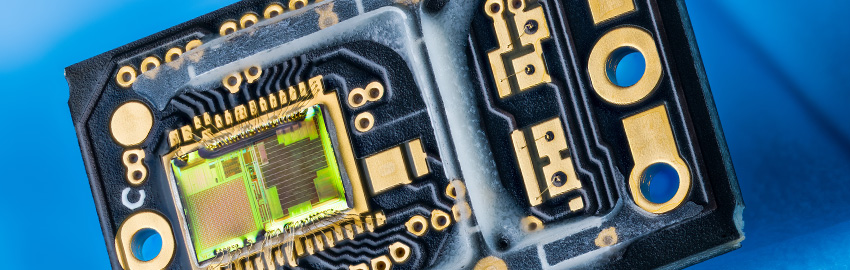

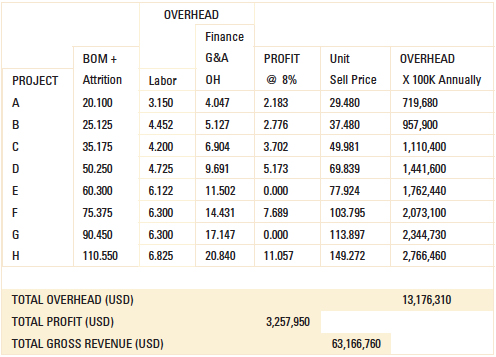

The factory matrix in Figure 2 shows a hypothetical example of a zero profit program and its contributing value to an EMS, and highlights the overall contributions by project. For this hypothetical example, this factory is producing $63.1 million in net sales with a profit of $3.2 million. The overhead is $13.1 million. Although projects E and G have zero profit, the projects are contributing heavily toward the absorption of overhead burden with project E = $1.7 million plus G = $2.3 million, for a total of $4 million. Since the overhead of the factory is relatively fixed, we can conclude the absence of projects E and G would shift the factory from a profitable to unprofitable operation. Hence, if the UPW was used as the sole calculator of a project’s value, the factory projects E and F would have been declined. With this, the overhead absorption would have been lost, shifting the factory into a negative revenue operation.

Figure 2. Sample Factory Matrix

As an aside, I would argue reported costs associated with overheads, facilities, utilities, GNA and other overhead variables are assigned in an arbitrary fashion, or at least, with little tangible reference. Thus, UPWs, outside of the bill of materials and labor costs, are fixed around generalizations of overall operating costs that cannot be broken down per project. Thus, “fudge factoring” leading to arbitrary quantitative analysis is the means to distinguish a cost breakdown. Keep this in mind as we proceed in this discussion.

EMS marketing strategy. The EMS’s marketing objective is to attract new customers and expand into new markets driven by its corporate target agenda. In doing so, an initial project from a target customer may require special considerations outside the parameters of the UPW. Similarly, any expansion in new markets or incorporating new technologies as part of the EMS’s offering will necessitate management’s consideration on all aspects of initiating quotes. It is these types of opportunities that require corporate management’s scrutiny that are often overlooked and neglected by the common sales process of using the UPW as the sole instrument to generate quotations and evaluate the program’s value.

UPW Misuse

By using the UPW as the Holy Grail to develop quotes and assess value of the potential project, the EMS is subject to lose business that is otherwise valuable. Directly below are four actual case studies where the EMS lost business opportunities that were actually valuable to the EMS operation.

Low margin with high volume production. A Tier 3 EMS was given the opportunity to step into a Tier 1 market space. The EMS was well-suited for this program, which has high-volume, high-spend (over $125 million) and a long history of annual production renewals. However, the EMS did not deliver a viable quote since the UPW revealed a low-profit margin for this high-volume quote package. It became obvious the EMS was stuck on the UPW’s profit line item. In essence, it could not discern the program’s value to the overall company operation, since profits were around 12% of the selling price. After six weeks of discussions, deliberations and negotiations, the clock ran out and the EMS lost the opportunity. In the aftermath, the EMS did conclude the business was valuable over the long term. Here the UPW’s profit line blinded the EMS’s business acumen.

Process over relevant business action caused delay. A Tier 3 EMS had a complete BoM list, samples of the unit to be quoted and all testing and general labor information. Yet it took over 16 working days to do a time study to come up with an exact labor assessment. The delay was due to a labor study that involved a plus or minus five-minute swing, a negligible item in the scale of the unit price. Since the Unit Price Worksheet was not completed, the quote delivery was delayed. The overall quote was delivered weeks later than required, and the OEM’s decision went with an EMS competitor and the opportunity was lost.

Not price-flexible due to perceived profit margin. A Tier 3 EMS ignored the potential customer’s target price, since the UPW produced a selling price that would be 9% higher than the customer’s “walk away” target price. The EMS finance management held its UPW-derived pricing, and the business was lost. Concurrent to this sales process, the EMS factory was running at a mere 60% capacity for more than a year. The lost business would have made a healthy contribution toward factory overhead absorption.

Adjusted UPW indicated project is “unprofitable.” In another profit-oriented decision, a Tier 3 EMS was asked to lower its selling price by 8%. The UPW was adjusted by totally eliminating the profit content, which happened to be 8%. With this adjustment of the UPW, the project showed a “zero” profit line; hence the program was deemed “unprofitable” by the EMS. The RFQ was unceremoniously shelved. In review, the potential customer was a targeted multinational corporation with a significant amount of year-to-year annual spend.

Best Application of UPW

Contrary to all the points discussed above, the UPW does have a valuable working document use, but for a different reason. Rather than being utilized as the sole unit sales price calculator, the UPW serves to manifest the EMS’s offered selling price in the realm of an open book quotation. Specifically, the UPW is used as an “if-then” statement. That is, the final selling price is based on the posted cost parameters. “If” the cost parameters are changed (such as a component adjustment or cost of component), “then” the selling price will be adjusted accordingly. To achieve this form of documentation, the UPW is to be engineered to reflect the final agreed-to unit selling price. Once a purchase order is officiated, the UPW serves to eliminate misunderstandings, limit aggressive commercial demands by either party and reduce anxiety as changes occur during the course of a product’s lifecycle. I have found the UPW, when utilized accordingly, places both the EMS and customer in a zone of mutual understanding, while setting the stage for ongoing cooperation.

The practice of using the unit price worksheet as the sole exercise to set unit pricing and value of a customer has evolved through a convergence of EMS market pressures:

- The RFQ process has morphed into a more structured, automated exercise due to pressures of time, bandwidth of management and desired profit lines.

- OEMs require open book quotes.

- Increasing EMS competition calls for quicker RFQ responses.

- Understaffed EMS management has set the quote process to be relatively automated.

- CFOs and finance departments have tighter control on cash and thus more influence in sales development matters.

- The UPW is a convenient tool to derive a unit sell price with speed, accuracy and approval of EMS management.

- The EMS’s overheads are arbitrarily distributed from project to project.

- Applying the UPW as sole unit selling price calculator will cause the EMS to lose true criteria in assessing a potential customer’s business valuation.

- EMSs lose valuable business due to regimented implementation of the UPW.

Recommended remedies the sales process must reclaim and implement include:

- Each RFQ must be reviewed by corporate management to ensure a proper disposition is taken regarding the respective potential customer. The RFQ must be reviewed with regard to marketing agendas, short- and long-term business development and strategic factory loading factors.

- The UPW needs to be reverse engineered in order for it to function as a working manifest of the quote document.

- A UPW is an excellent “if-then” tool to manifest the agreed-to unit price and serves as a true working document to lock in an if-then approach.

With specific monitoring to reduce or eliminate the reliance of the UPW, EMS business development efforts will be geared to a more effective evaluation of a unit price platform, as well as an assessed value of a potential customer. With this practice, the EMS will regain the capability to secure valuable business that would not only be profitable but beneficial to the factory’s current status requirements. The examination of potential customers and its projects must be subject to corporate evaluation with respect to deeper study of the current needs of the factory at the time of the RFQ entry. In essence, EMSs must reexamine their sales process and interject a fundamental platform utilizing effective processes in assessing new business opportunities.

Joseph Fama is a senior executive who has spent 25 of his 30 years in the global EMS marketplace with Singaporean, Chinese and US EMS and systems companies in sales and marketing; This email address is being protected from spambots. You need JavaScript enabled to view it..